Stock formula

As well as enabling you to track current stocks and shares information it can also be used to retrieve historical securities data. He inverted the PEGY ratio to.

Safety Stock Meaning Importance Formula And More Safety Stock Accounting Books Accounting And Finance

This article throws light upon the four major types of stock levels of inventory.

. Below is the formula to calculate stock Beta. If you want to compare the yield of different investments then this may be a more useful number than the PE ratio. The second one is more accurate albeit more complex.

This function imports data from the Google Finance web application which provides daily stock prices news from the. Formula One stock is a tracking stock for the assets under Formula One Group with Liberty Media. Shelves typically stocked with baby formula sit mostly empty at a store in San Antonio Tuesday May 10 2022.

Peter Lynchs fair value formula is a simple ratio that gives an indication of a stocks valuation range. Stock Beta Formula COVRsRM. This ratio helps improve the inventory management as it tells about the speedy or sluggish flow of inventory being utilized to create sales.

Safety Stock Z sqrt Average Lead Time Standard Deviation in Demand ² Average Sale Lead Time Standard Deviation ². The Closing Stock or the closing inventory Formula is Opening Stock Purchases Cost of Goods Sold. The symbols a spreadsheet uses for calculations are.

75 32 50. Market to Book Ratio Market Capitalization Book Value. Peter Lynchs Fair value is based on the PEGY ratio.

Rp D P0. This is the cost of goods which will be available for sale. It primarily includes direct labor costs and cost of raw material.

To calculate the new price per share. For example a company with a stock price of 20 and an EPS of 1 has a PE ratio of 20 20 1 and an earnings yield of 5 1 20 100. Formula One Group is a subsidiary of Liberty Media which purchased the firm in January 2017.

This represents the quantity which must be maintained in hand at all times. Value of stock CCEDGREDP. Check out Growing Annuity Formula.

Later in his book Lynch layers in a few variations to the standard PE ratio formula to offer a more in-depth level of company performance analysis. A company has preferred stock that has an annual dividend of 3. Profit Stock Price at Expiration Current Stock Price Premium.

Then multiply the gross profit percentage by the sales to find. Rp 400 1 20 5000 20 The formula above tells us that the cost of preferred stock is equal to the expected preferred dividend amount in Year 1 divided by the current price of the preferred stock plus the perpetual growth rate. For example a stock currently trading at 75 per share splits 32.

If you owned two shares before the split the value of. This calendar was last updated 11 July 2022 1104. A warrant is a derivative that confers the right but not the obligation to buy or sell a security normally an equity at a certain price before expiration.

AP PhotoEric Gay Shelves typically stocked with baby formula sit mostly empty at a. Here EDPs has expected dividend per share CCE is the cost of capital equity and DGR is the dividend growth rate. The stock turnover ratio formula is the cost of goods sold divided by average inventory.

Else If Stock Price at expiration Strike Price Then. You divide a companys market capitalization by its book value. So to calculate the Profit enter the following formula into Cell C12 IFC5C6C6-C4C7C5-C4C7 Alternatively you can also use the formula MINC6-C4C7.

However the excel formula comes to our rescue. Now from this data we have to calculate common stock by using the formula. The basic safety stock formula is the traditional method and takes into account the number of products you sell per day and the number of days of stock you want to hold at any one time.

Plus sign for adding one number to another. The formula to calculate the new price per share is current stock price divided by the split ratio. Firstly determine the cost of goods sold incurred by the company during the period.

At the time around 1962 when Graham was publicizing his works the risk-free interest rate was 44 but to adjust to the present we divide this number by todays AA corporate bond rate represented by Y in the formula above. Rp 3 25 12. Stock intrinsic value calculator excel.

Reorder Point Safety Stock Average Daily Sale or Forecast Average Lead Time 2 Kings Method. Market cap is calculated by multiplying the stock price by the number of shares outstanding. Earnings Yield EPS Stock Price 100.

The formula is essentially the same except the number 44 is what Graham determined to be his minimum required rate of return. A stock trading at a PE ratio of 20 for instance is trading at 20 times its annual earnings. Rp D dividend P0 price For example.

The price at which the. If the current share price is 25 what is the cost of preferred stock. So after calculation common stock of the company remains at.

The Black Scholes model also known as the Black-Scholes-Merton model is a model of price variation over time of financial instruments such as stocks that can among other. Common stock Total EquityTreasury stock-Additional paid-incapital-preferred stock-Retained earnings. The calculation is 100 products x 5 days worth of stock.

The Cost of Preferred Stock Formula. Some call the PE ratio the price multiple or the earnings multiple. Black Scholes Model.

Peter Lynchs method for stock fair value calculation is suitable for high-growth companies. How to calculate the market to book ratio. The GOOGLEFINANCE function allows you to import real-time financial and currency market data straight into Google Sheets.

The formula for a stock turnover ratio can be derived by using the following steps. It is the sum of all the direct and indirect costs that can be apportioned to the job order or product. We need to add the cost of beginning inventory or the opening inventory to the cost of purchases during the period.

The formula used to calculate the cost of preferred stock with growth is as follows. For this reason the cost of preferred stock formula mimics the perpetuity formula closely. If stocks are less.

Whenever you plan to calculate the stock there are various methods of a shares intrinsic value. For example if you sell 100 products per day you want to have five days worth of safety stock. A formula then has a symbol for what kind of calculation you want to perform add subtract multiply divide etc.

What is the Peter Lynchs Fair Value Formula. A formula starts with an equals sign that tells the spreadsheet you want to do a calculation. The formula to calculate the market to book ratio is very simple.

Profit Strike Price Current Stock Price Premium. The stocks Beta is calculated as the division of covariance of the stocks returns and the benchmarks returns by the variance of the benchmarks returns over a predefined period.

Formula 1 Super Stock Tires It Was The 80s Ford Trucks Ford Pickup Vintage Hot Rod

Pin On 热点

How To Pick Value Stocks Using Joel Greenblatt S Magic Formula Value Stocks Investing Formula

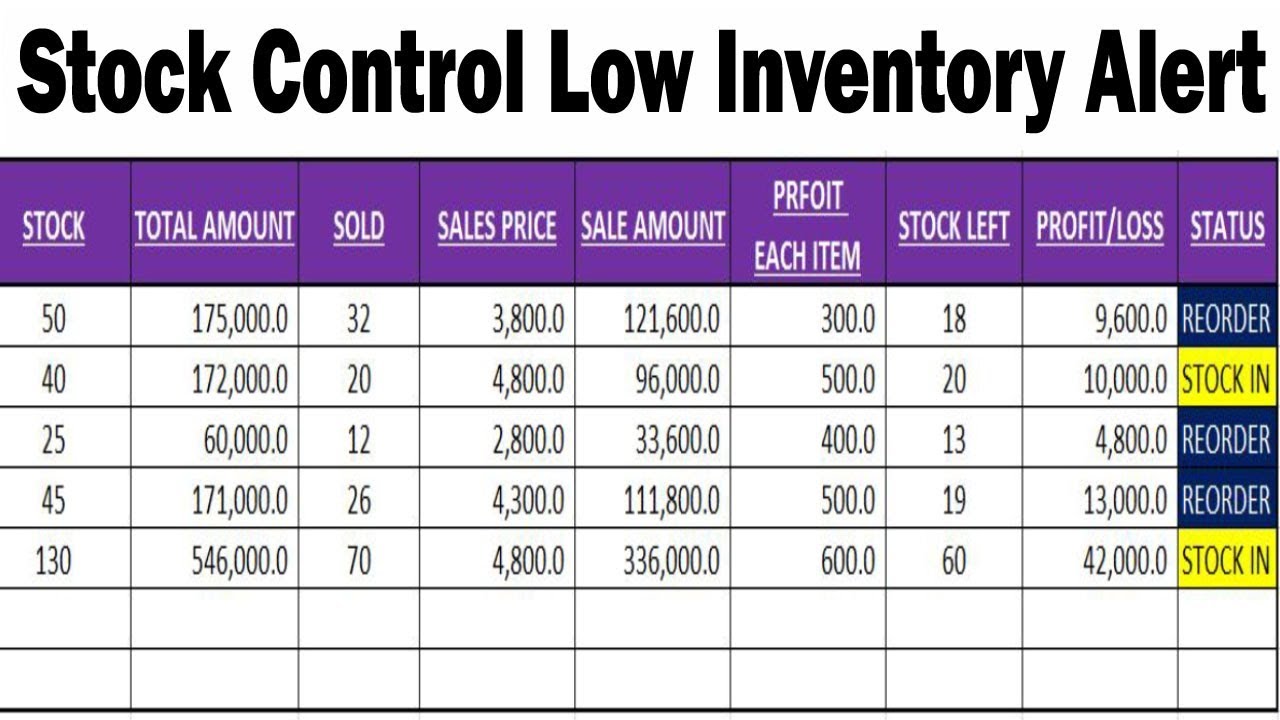

Stock Calculation Stock Reorder Stock Reorder Alert In Excel By Lear Learning Centers Excel Tutorials Free Learning

Stock Calculation Formula In Excel Stock Management In Excel Sheet Excel Development Formula

What Is The Formulas To Find Out Opening Range Breakout Of A Stocks How To Find Out Breakouts Stock Market

Pin On Search At Yt Chemistry By Saad Anwar

Equity Value Formula Calculator Excel Template Enterprise Value Equity Capital Market

What Is The Intrinsic Value Formula Try This Online Calculator Getmoneyrich Intrinsic Value Learning Mathematics Fundamental Analysis

3 Magic Formula Stocks Ready To Move Up Stock Analysis Value Investing Formula

Earnings Per Share Formula Eps Calculator With Examples Stock Trading Strategies Earnings Financial Education

Pin By Arturo Rodriguez On Finance Option Pricing Pricing Formula Stock Options

How To Calculate Warren Buffett S Margin Of Safety Formula Excel Investing Investing Rules Stock Market

Learn Stock Trading Position Sizing The Right Way Enlightened Stock Trading Stock Trading Positivity Learning

Weighted Average Cost Of Capital Wacc Excel Formula Cost Of Capital Excel Formula Stock Analysis

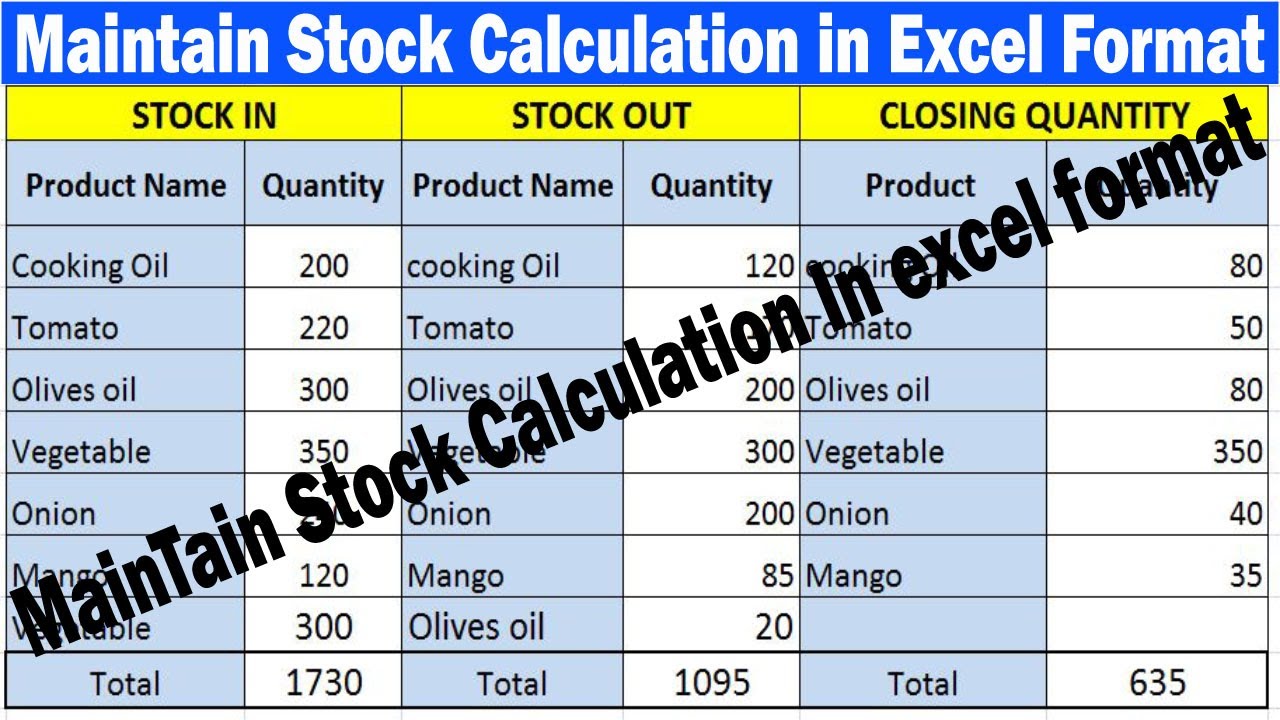

How To Maintain Stock In Stock Out And Closing Stock In Excel Format By Learning Centers Excel Tutorials Excel

Reorder Point Calculating When To Reorder Tradegecko Safety Stock Point Formula